Open your Trading and Demat Account

How to open an account with us:

Instant and 100% paperless.

All your details are verified.

E-Sign, and you are all set to trade.

Sign Up Now

Select Dependency

Enter OTP

120s Waiting for OTP...Your contact details please!

Share your email id

We will verify it through OTP

Share your reference/RM code

For Reference/RM Code please call on +91 8069159999

Email ID *

Select Dependency

Do you need Relationship Manager ?

Reference Code

Your contact details please!

Share your email id

We will verify it through OTP

Share your reference/RM code

Enter OTP

120s Waiting for OTP...You will receive an OTP on your Email ID

We'll begin with your PAN First

Insert Your PAN and Date of Birth as mentioned on your PAN Card

Your Account Name will be taken as mentioned in the Income Tax Database

Under new PMLA regulations, pleae ensure that your Aadhar Number is Seeded in your PAN

PAN (Permanent Account Number)

Date Of Birth (as per Pancard)

Choose Your Segments

Select your trading preferances.

Select brokerage plan as per your requirements.

Make payment from your preferred mode.

Do you whish to execute DDPI ?

click here

to know what is DDPI

Referal Code

Account opening charges Rs:400+GST (Including 1year Dp AMC Rs: 300+ GST Rs: 100 POA)

400.00

GST 18%

72.00

Amount Payble

472.00

Share Aadhar details from Digilocker

Do not worry if you have never registered with Digilocker. Click on the button "Connect To Digilocker". Digilocker will open as a pop-up on your screen where provide your Aadhaar number and authenticate with OTP. You will then be required to set your PIN and give your consent to provide your Aadhaar document to us for KYC. Your 12 digit Aadhar number is never fetched, stored, revealed or collected. The Aadhaar and the PAN should belong to you.

My sole country of tax residency India

Father's / Spouse Name

Marital Status

Spouse Name

Annual Income

Politically Exposed

Mother's Name

Education

Trading Experience

Occupation

Do you want to add nominee

Bank Account Details

Provide Bank account details wherein you are sole/primary holder

We'll verify your bank account by transferring one rupee into it

Bank Account Number

Confirm Account Number

IFSC Code

Account Type

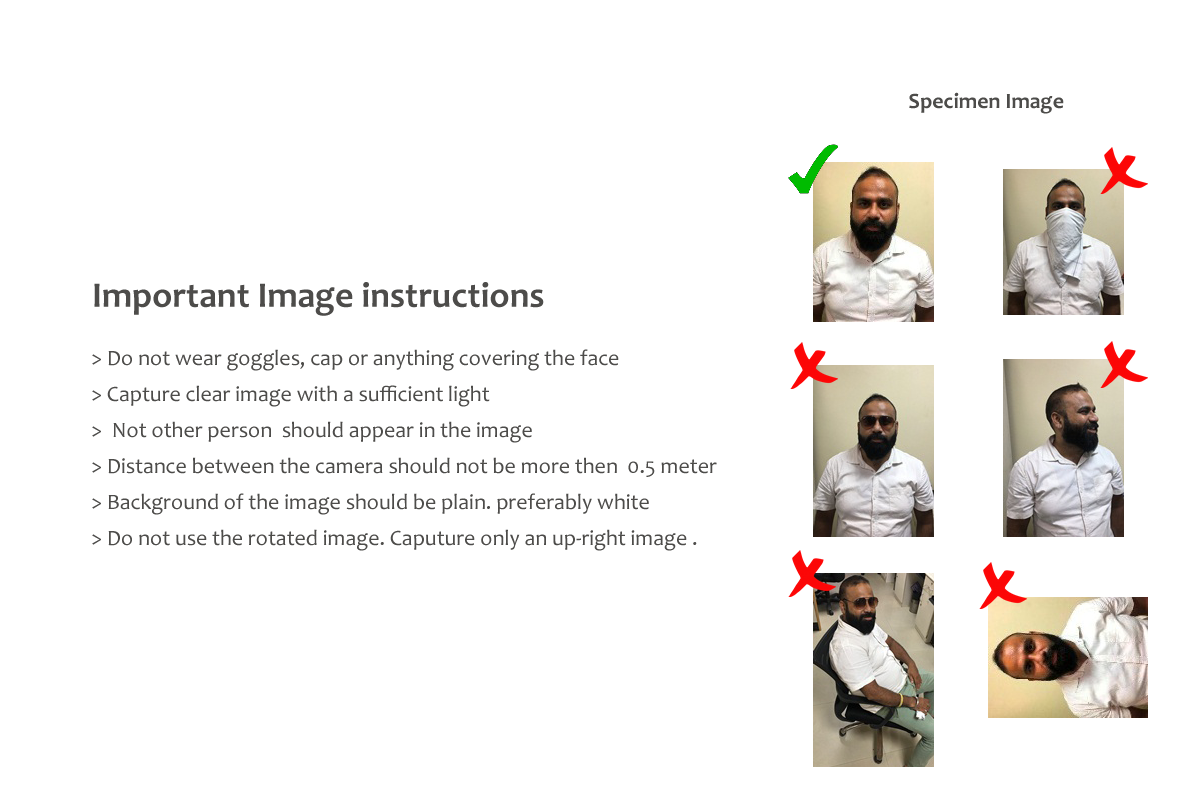

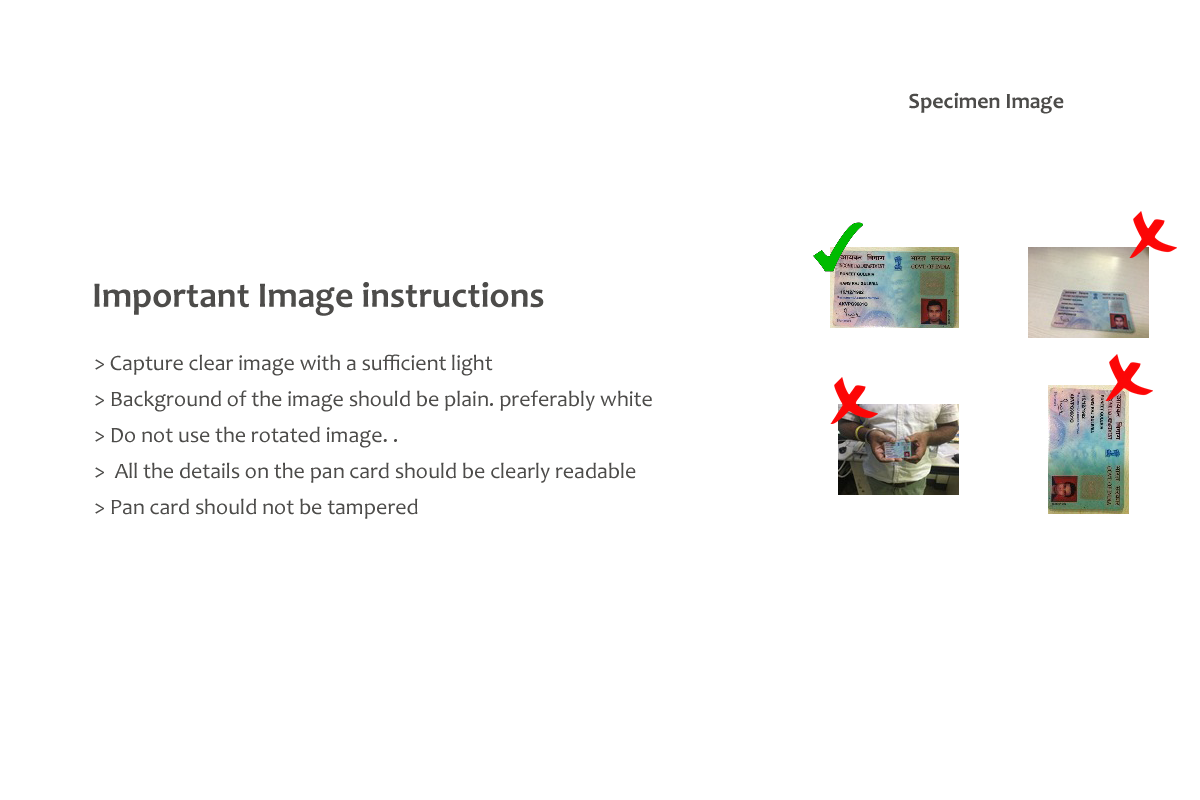

Upload Your Document - Final Step

PAN Copy

Your current signature

Income proof

Only required if you want F&O and MCX trading. Not required if you just want to buy and sell equity stocks.

Please provide password if you are uploading a password protected file

Bank proof

Please provide password if you are uploading a password protected file